(Focus on Italy, global coordination for winery/consortium decisions and M&A).

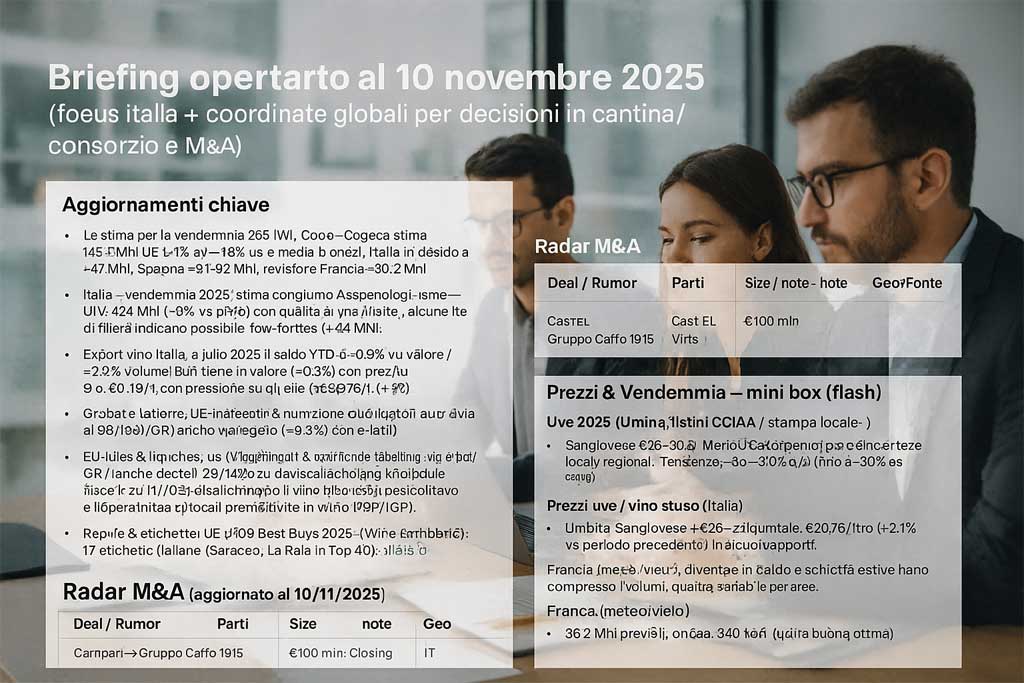

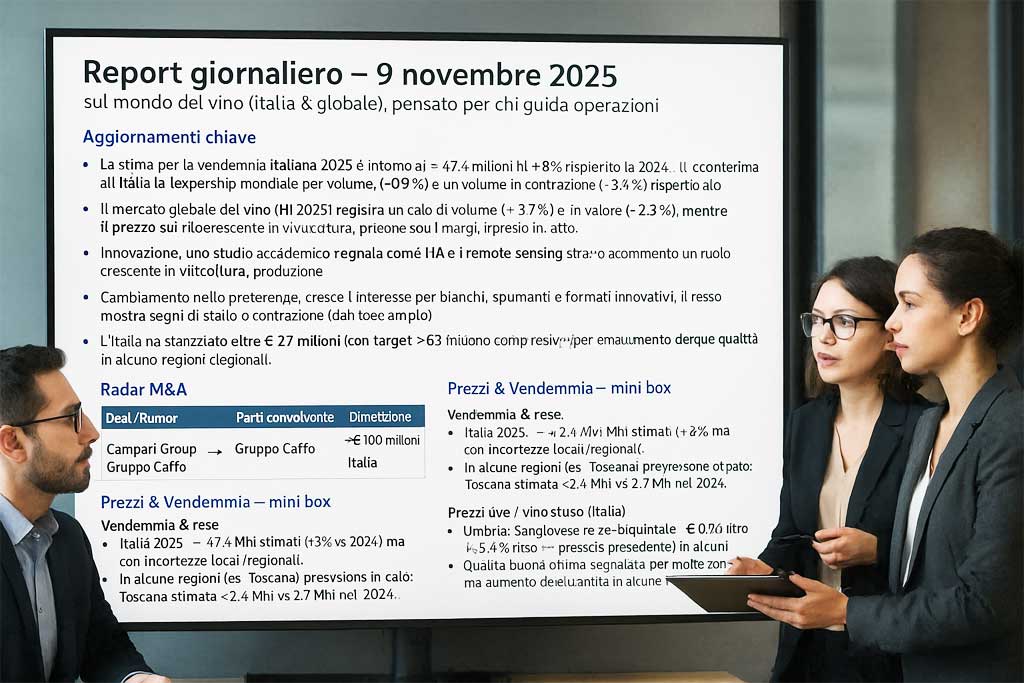

A no-frills operational briefing , updated as of November 13, 2025, to support strategic decisions in wineries, consortia, or M&A transactions in the wine sector (Italy, global coordinates). (Yes, nerd mode activated.)

1. Global situation

Production

- The Organisation Internationale de la Vigne et du Vin (OIV) estimates world production of ~232 million hectolitres (mhl) for 2025, 3% compared to 2024 but still approximately -7% compared to the five-year average.

- In Europe, France recorded its lowest harvest since 1957, Spain its lowest level in 30 years. Bucking the trend, Italy, thanks to favorable weather, is recording an 8% increase compared to 2024. Implications : low global volumes → potential rationalization of inventories / lower surplus → margin for price stabilization but also risk of cost/quality reduction in wines.

International Demand & Trade

- The global wine market is estimated to be worth around USD 231 billion in 2024. The CAGR for 2025-2030 is expected to be between ~4.6% and ~7.1%.

- Global trends: growing demand for premium wines, sparkling wines, organic wines, and experiential experiences (wine tourism).

- However, there are signs of a slowdown in consumption in some mature markets, and trade instability (tariffs, exchange rates). For example, the US market is becoming more volatile.

M&A and consolidation

- In the global landscape, the importance of after-sales operations is growing, along with the search for vertical efficiencies (vineyard→winery→brand), and digitalization/sustainability as evaluation drivers.

- In Italy specifically: the 2025 Mediobanca report notes that uncertainty (consumption, internationalization) has reduced M&A activity in 2024; there will be an almost complete absence of investment funds in the domestic wine segment. Implications : opportunities for strategic players with expertise and vision (like yours) to operate in selected targets, perhaps under more favorable conditions.

2. Focus Italy

Production and quality

- For Italy: 2024 production estimated at ~44.1 mhl (15% compared to 2023), still approximately -6% compared to the five-year average.

- For 2025: initial estimates indicate ~47.4 mhl (8% compared to 2024), but more conservative revisions indicate ~44 mhl. Grape quality is reported as “good-excellent,” but weather remains an unknown. For you (wineries/consortia/M&A) : pay attention to vintages and quality as value drivers. In M&A, evaluate the consistency of the potential quality harvest, not just volume.

Export

- In the first 4-5 months of 2025: Italian exports in volume -3.4% and in value -0.9% compared to the same period in 2024.

- In the first 6 months of 2025 (12 key markets): Italy 2.1% in volume and 1.5% in value, better than the global average (-1.3% volume).

- In July 2025: Italian exports down 3.4% in volume / 0.9% in value; the United States in sharp negative territory (tariffs, falling demand). Cellar inventories as of September 30: ~36 mhl (-9.6% vs. July, 1.3% y/y) → pressure on wholesale prices. Operational implications :

- US Markets: High Risk, High Exposure = Vulnerable.

- The sparkling wine segment (e.g. Prosecco) remains a beacon: for example, Italian sparkling wines increased by 10% in value in the first seven months.

- For M&A: targets with strong export resilience in secondary markets (Asia, Canada, Europe) become more strategic.

Domestic consumption & retail channel

- In Italy, large-scale retail trade: turnover ~€3.1 billion, 0.6% in value but -1.8% in volume.

- Food and wine tourism: The wine tourism market in Italy is expected to grow strongly, with a CAGR of ~8-9% in 2024-25. For you : the domestic channel is stable/slightly growing in value, but quality and experience (tourism, hospitality) must be emphasized as differentiating factors.

Product and consumption trends

- Obvious trends: indigenous wines, fresh whites, rosés, low-intervention wines, premium sparkling wines.

- The “premium” and “experiential” segment has greater margins and appeal in foreign markets.

- Sustainability, digitalization, and traceability are becoming entry criteria (including for acquisitions). M&A/strategy implications : focus on brands with a history, distinctive terroir, and certified sustainability; during due diligence, evaluate the level of digitalization, automation, and winemaking efficiency.

M&A in Italy

- The Italian sector is still fragmented, with deals tending to involve vertical integrators or regional mergers. Funds are very limited.

- Valuation of wineries with stable exports, recognized brands, and real estate assets (vineyards, cellars) that support added value. An operational tool for you : you can position yourself as a “trusted partner” for the selling entrepreneur, managing not only the economic valuation, but also the industrial, commercial, and positioning aspects, and coordinating professionals.

Main risks to monitor

- Weather/climate risk (frost, drought, hail) → production volatility.

- Tariff/commoditization risk in export markets.

- Slowdown in consumption in mature markets, new generations with different consumption (less volume, more experience).

- Pressure on margins if you don’t scale or differentiate.

- Valuations too high for “commodity” assets.

- Rising costs (energy, transportation, bottling) are compressing margins. For you : when evaluating your operation, consider a conservative 3-5 year scenario, stress test production margins, and risky exports.

3. Operational strategic recommendations

For wineries / consortia

- Strengthen premium/experiential positioning: tourism, hospitality, visit-&-stay, wine clubs, vertical events.

- Develop distinctive indigenous and terroir-driven brands: focus on innovation (low-intervention, whites, rosés, sparkling wines).

- Focus on production and digital efficiency: precision viticulture, traceability, sustainability. Reduce costs, improve quality.

- Diversify export markets: reduce excessive dependence on the US; strengthen markets in Canada, Asia (Japan, South Korea), and Central Europe.

- Inventory management and pricing: With global volumes compressed, monitor the inventory-sales balance to avoid discounting.

For M&A / acquisitions / divestitures transactions

- Ideal target: winery with a recognized brand, consolidated export presence, efficient productivity, well-documented real estate assets (vineyards, cellar), strong terroir/quality profile.

- In-depth due diligence on: historical production, year-to-year variation, quality indicators, profitability (EBIT margin), export mix and market risks, fixed/variable costs, debt, real estate/land assets.

- Evaluate scenarios: conservative baseline scenario (e.g., 5-10% drop in exports, bad year), and consider synergies (marketing, distribution, digital).

- Transaction structure: consider earn-outs, results-oriented tools to align seller and buyer, and integrate coordinating professionals (lawyers, tax advisors, and technicians) for a quick and clean closing.

- Post-acquisition: plan the operational “day 1” with brand integration, distribution channels, possible restructuring of the winery and cellar, and sustainable governance.

Timing and moment evaluation

- The current environment is favorable for strategic buyers with vision (fewer aggressive funds present, compressed volumes → potentially more reasonable valuations).

- However, don’t underestimate the climate/export risks. It’s better to move now with manageable targets rather than wait for major deals that could trigger competition and costs.

- Consortia: evaluate internal mergers to increase critical mass, efficiency, brand pooling, and cooperative exports.

Key KPIs to monitor

- Production (hl) per hectare, yield, quality (chemical-sensory analysis points).

- Export volume and value (% growth/decline, markets, price mix).

- Operating margin (EBIT) and net profit. In Italy, the margin improved by 0.5 percentage points in 2024 compared to 2023.

- Stock/cellar (mhl) and bottling level, bulk vs bottle.

- Brand awareness/premium positioning.

- Winemaking in the cellar – level of automation, sustainability, certifications.

- Tourism-experiential capacity (room occupancy, visits, e-commerce).