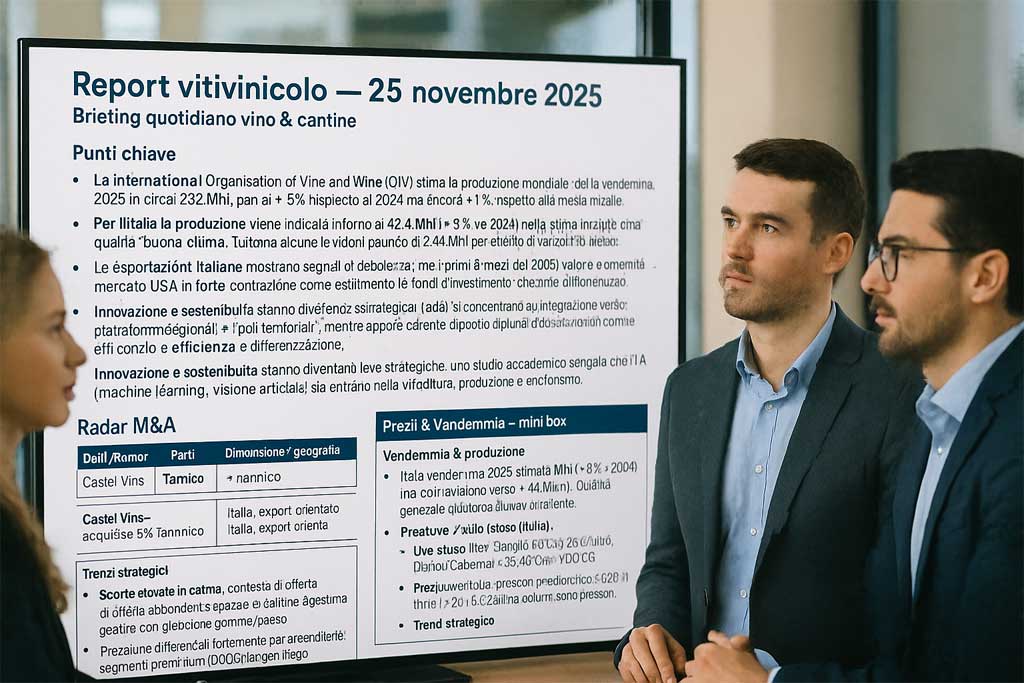

The last week of November highlights a wine sector embedded in a rapidly growing national agricultural and agri-food landscape, driven by certified quality, dynamic exports, and a significant evolution in consumption.

The picture shows a solid Italian wine industry, increasingly premium and at the heart of high-value-added supply chains.

A €21 billion DOP economy: stable wine, accelerating exports

The XXIII Ismea–Qualivita Report confirms the strength of certified production: the PDO Economy will reach 20.7 billion euros in 2024 , 25% compared to 2020, with 328 Consortia , 184 thousand operators and an employment growth of 1.6%.

Bottled wine maintains a stable value of 11 billion , while overall PDO and PGI exports reach a new high: 12.3 billion euros (8.2%) , thanks to simultaneous records for food and wine.

The most dynamic areas are Lombardy (13%), Friuli Venezia Giulia (8%), and Puglia (12%). Veneto and Emilia-Romagna remain the epicenters of value, with a total of 8.9 billion .

Among the wines with the highest production value, the following stand out:

- Prosecco Dop: 951 million (0.5%)

- Delle Venezie Dop: 193 million (9%)

- Conegliano Valdobbiadene-Prosecco DOP: 170 million (slightly down)

Made in Italy exports: wine leads growth

ISTAT data for September 2025 show foreign trade expanding: 10.5% in value , 7.9% in volume . Food and beverage grew by 6.9% in the month and 5% in the first nine months of the year, confirming its role as a cornerstone of the Italian trade balance.

Wine remains one of the most sought-after categories in premium markets, especially in non-EU countries. Exceptional performance:

- United States: 34.7% , driven by wine and cheese

- France: 19.5%

- Spain: 14.7%

- Poland: 15%

- Switzerland: 10.4%

- OPEC countries: 24.2%

Growth is based on certified quality, local identity, traceability, sustainable supply chains, and a structured presence on international markets.

Italian agriculture: €44 billion in added value

The Italian primary sector achieved a historic result: over €44 billion in added value , first in Europe. According to AGEA and INPS, government investments— €15 billion —have revitalized the sector, supporting:

- recovery of 5 million hectares of abandoned land,

- generational change,

- increase in productivity and employment.

This agricultural solidity offers fertile ground for the entire wine industry, which benefits from policies geared towards production, legality, and the valorization of cultivated land.

Consumers, bubbles and new drinking cultures

The IULM analysis photographs a wine market in full transformation:

- Italy is the third country in the world in terms of consumption by value .

- Internal growth is driven by the pursuit of quality: less quantity, more value.

- The sparkling segment continues to drive demand: 3.1 billion euros and 733 million litres in 2023 , with a clear premiumization dynamic.

- Champagne sales are down (-8.4% globally), but Italian sparkling wines confirm their national and international leadership.

- The low and no alcohol segments are increasing (5.9%) , especially among young consumers.

Gen Z is pushing for a different approach to wine: greater attention to sustainability, essential storytelling, light consumption opportunities, innovative formats, and greater health awareness.

Conclusion: a solid sector evolving towards quality, sustainability and premium positioning

Italian wine closes November 2025 with a strong structural picture: growing exports, certified production generating value, a national agriculture that invests, and a transforming domestic market.

The direction is clear:

Less volume, more value; less standardization, more identity; less tactics, more supply chain strategy .

This trend confirms the positioning of Italian wine as a crucial economic and cultural asset for Made in Italy and as a sector requiring informed industrial decisions, targeted investments, and a long-term strategic vision.