The Italian and European wine sector is experiencing a period of apparent stability, but beneath the surface, profound transformations are taking place that are reshaping production, trade, and consumption.

Wine Trends in Italy – Week 3-7 November 2025 (Analysis by Eros Zago)

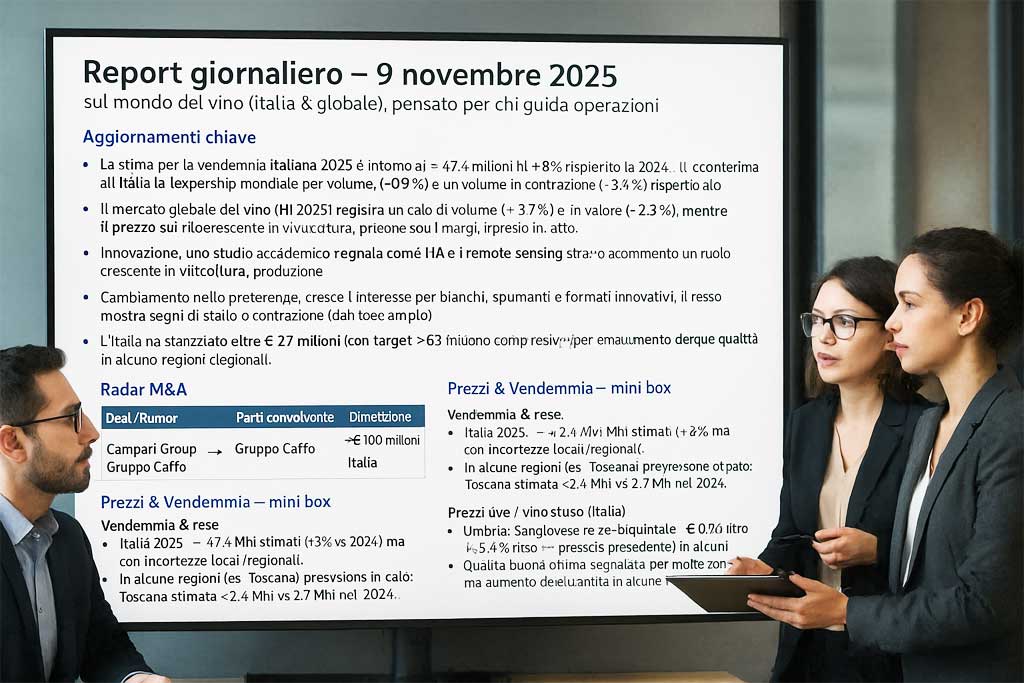

The week ends with a complex picture: signs of production recovery, tensions on international markets, an increasingly selective consumer, and new strategic lines for the relaunch of Italian wine.

European production: apparent stability, structural fragility

European Union wine production is estimated at 145.5 million hectolitres for 2025 (1% compared to 2024), but remains 7.5% below the five-year average.

Italy confirms its leadership with 47 million hectolitres (8%), ahead of France (37 Mhl, 2.3%) and Spain (31.5 Mhl, -15%).

Behind the slight recovery in volumes lies a long-term downward trend: since 2018, EU production has fallen by over 40 million hectoliters. 2025 was marked by extreme weather events and a complex trade environment, exacerbated by new US tariffs on European wines.

Fine wines and new tastes: the era of “liquid awareness”

According to the London Fine Wine Trends Report from London club 67 Pall Mall , the fine wine market is transforming.

The evolved consumer favours authenticity, drinkability and immediate value , while the myth of big labels and the “en primeur” system is losing its appeal.

Interest in South Africa (26% in 10 years), English Sparkling Wine (79% since 2015) and consumption of Italian wines (37.5%) are growing, particularly from regions such as Sicily and Tuscany .

The future of fine wine will be driven by a more informed, digital and independent public, with increasing attention to sustainability, low alcohol content and lightweight packaging .

Geopolitics and Trade: Italy Seeks a Transatlantic Alliance

In Rome, the meeting between Lamberto Frescobaldi (UIV) and European Commissioner Maroš Šefčovič confirmed the need for a common strategy to counter American tariffs and accelerate treaties with Mercosur and India .

Italy is aiming for an alliance with American trade , emphasizing that every dollar invested in EU wines generates $4.50 for the US economy. Wine thus also becomes a tool of economic diplomacy .

Signs of recovery: Financial law and dealcoholized wines

Two pieces of news fuel confidence in the future of the sector:

- 2026 Budget Law – Budget law provides for an increase in funding for promotion and internationalization of up to €250 million annually for the three-year period 2026-2028.

- Decree on dealcoholized wines – currently awaiting final approval, will open a new production frontier, meeting the growing demand for low- and no-alcohol wines .

A double strategic step towards a more competitive, modern, and international Italian wine.

Global trade and re-exports: the new geography of wine

The OIV study quantifies the value of global re-exports at 4.55 billion euros , equal to 13.5% of the total.

New hubs are emerging: the UK, Belgium and Singapore , high-value clearinghouses for premium and super-premium wines.

For Italy, re-export represents approximately 8% of total exports , highlighting the growing importance of distribution as a strategic lever for competitiveness and profitability.

Domestic consumption: “less, but better”

The NielsenIQ data presented at Milan Wine Week depicts an Italy that drinks less but makes better choices.

In off-trade channels, volume is decreasing but value is increasing, driven by sparkling wines, versatile whites and DOC/IGP .

The 30-44 age group is leading the transformation: informed, sustainable, price-conscious and open to deal-alcohol .

In the Horeca channel, the “quality of the experience” dominates: a thoughtful wine list, local storytelling, and staff training.

The trend towards premiumisation is consolidating: less quantity, more identity and transparency.

European policies: simplifications and flexibility

The European Parliament, through the Agriculture Committee (COMAGRI), has approved the amendments to the “Wine Package” , which simplify labelling, promotion and financial management .

A step forward towards more efficient regulation, with greater support for exports and long-term promotional projects.

Conclusion: the future of Italian wine

Italian wine enters 2026 with solid foundations but decisive challenges : economic sustainability, market diversification, digitalization, and new consumption styles.

Italy maintains its manufacturing leadership, but must now consolidate it with a vision of value, identity, and innovation .

The watchword is clear: less quantity, more strategic quality —from the vineyard to the table, from the territory to the world.