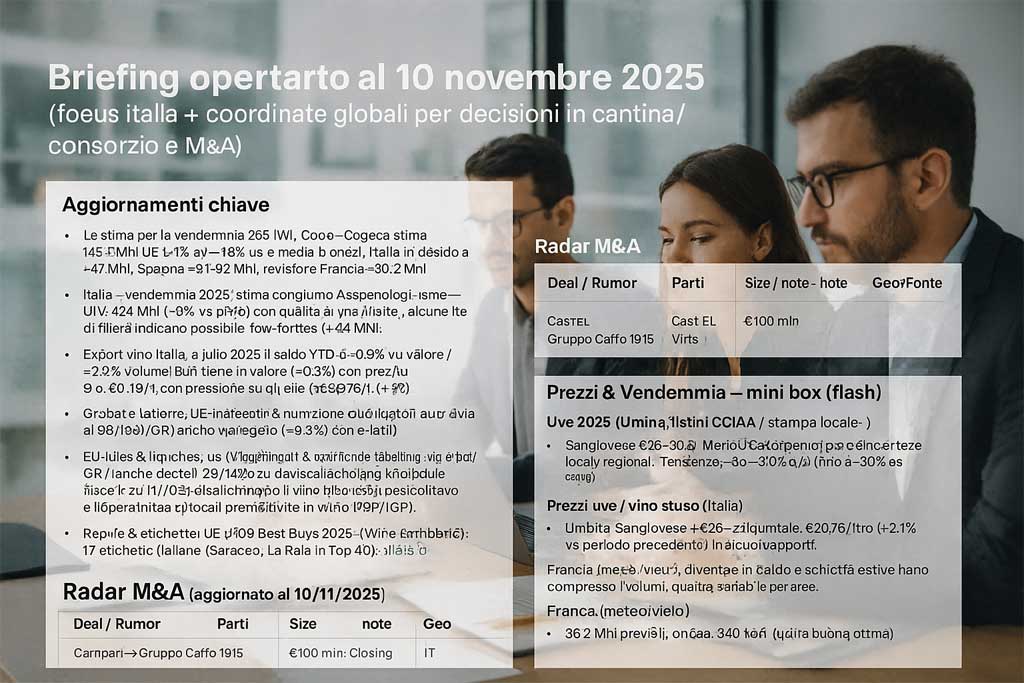

(Focus on Italy, global coordination for winery/consortium decisions and M&A)

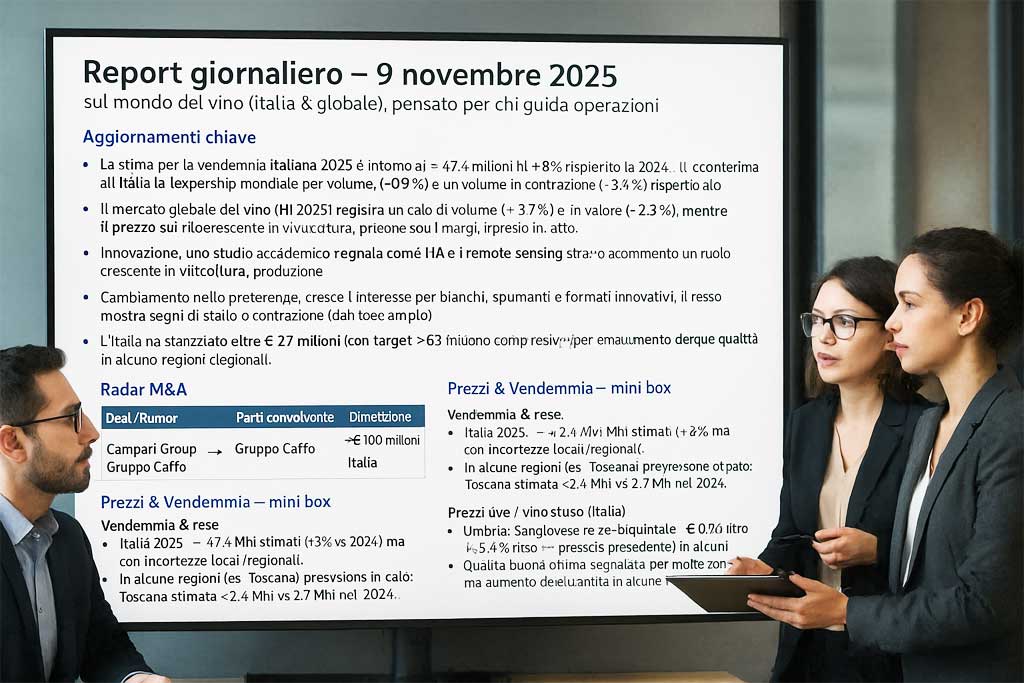

Key updates

- At European level, Copa‑Cogeca has estimated EU wine production for 2025 at 145.5 Mhl , up 1% compared to 2024 but still ‑7.5% below the five-year average .

- In Italy, the combined estimate by Assoenologi-ISMEA-Unione Italiana Vini is 47.4 Mhl (8% compared to 2024) with quality rated good/excellent; however, some industry sources report a potential adjustment towards the “low-forties”.

- On the export front, Italy recorded a decrease for the period January-July 2025: -0.9% in value / -3.4% in volume . In the United States, due to the 15% tariffs, a decrease in value of approximately -28% was recorded in the two-month period July-August.

- Stocks in Italy as of September 30, 2025 amount to approximately 36 Mhl , with a decrease of -9.6% compared to July but still 1.3% on an annual basis: this implies pressure on bulk and on the margins of more generic grapes.

- Globally, wine trade in the first half of 2025 recorded a -2.3% in value and a -3.7% in volume , while bulk wine filter held up better with a -0.3% in value and an estimated average price of around €0.78/L (2.1%).

- On the regulatory front, the EU has already mandated the inclusion of ingredients and nutritional information for wine (with the option of e-labeling/QR) since December 2023. The OIV has updated its 2025 standards regarding practices and labeling. In Italy, the decrees of December 20, 2024, and May 14, 2025, regulate the production of (partially) dealcoholized wine and its use in mixed-use premises.

- In terms of market recognition, Wine Enthusiast’s “Top 100 Best Buys 2025” ranking includes 17 Italian labels , with brands such as Saracco and La Raia in the Top 10, strengthening Italy’s “value for money” positioning in the premium segment.

M&A Radar

| Deal / Rumor | Parts | Size | Geo | Source |

|---|---|---|---|---|

| Transfer of the Cinzano & Frattina brands | Campari Group → Caffo Group 1915 | ~€100 million | Italy | source Reuters (June 26, 2025) |

| Tannico acquisition closed | CASTEL‑Vins ↔︎ Tannic | not disclosed | Italy/France | Forvis/Mazars press release (October 6, 2025) |

| Binding offer for Valle Talloria (former Giordano site) | Caffo Group 1915 ↔︎ Italian Wine Brands | not disclosed | Italy (Piedmont) | IWB press release (October 9, 2025) |

Prices & Harvest (mini-box)

- Grape varieties in Italy (e.g., Umbria, October price lists): Sangiovese €26-30/q; Merlot/Cabernet €28-30/q; Sagrantino DOCG €100-140/q. Trends: -~30% y/y , in some cases up to -50% vs 2023 ; the only exception is Trebbiano Spoletino, which is rising sharply due to scarcity.

- Global bulk wine H1 2025: average price ≈ €0.78/L (2.1% vs previous year) in a context of weak trade and cautious demand.

- Italian stocks: ~36 Mhl as of September 30; with an estimated 2025 harvest of ~47.4 Mhl (quality declared good/excellent) but with a risk of reductions in some areas due to weather/yield.

- France: Harvest forecast ~36.2 Mhl, influenced by heat waves and summer drought which are limiting both volume and qualitative uniformity.