on the main news in the world of wine and wineries, with a strategic eye for those working in the sector.

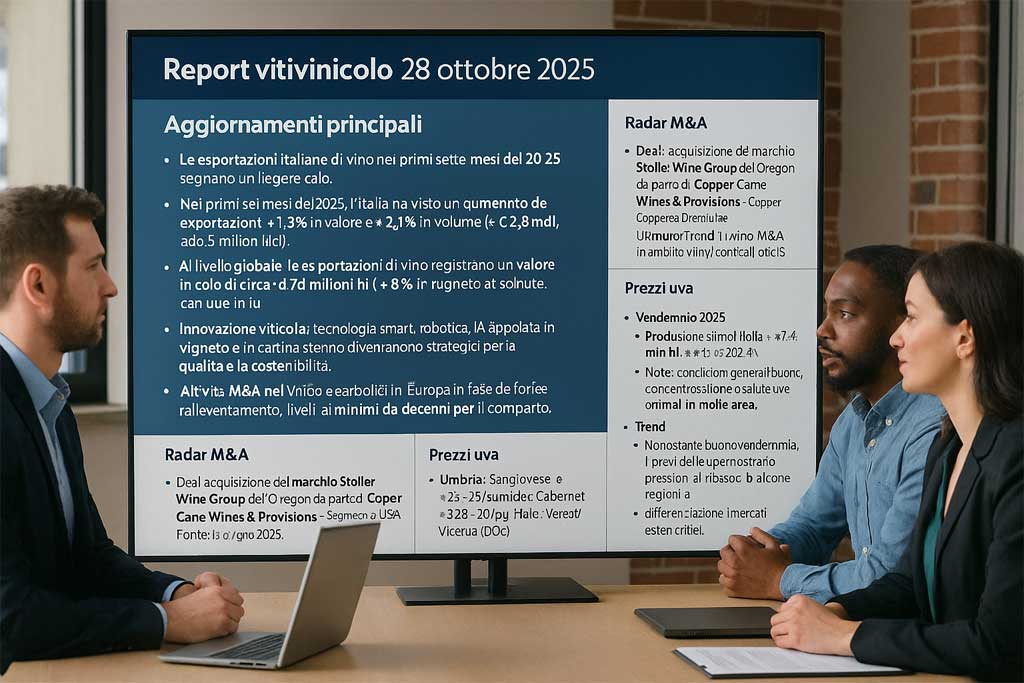

Major updates

- Italian wine exports in the first seven months of 2025 show a slight decrease: -0.9% in value and -3.4% in volume.

- In the first six months of 2025, Italy saw an increase in exports: 1.5% in value and 2.1% in volume (≈ €2.8 billion, 703.5 million litres).

- Globally, wine exports are expected to decline by approximately -2.3% in the first half of 2025 due to a competitive environment and pressure on foreign markets.

- On the harvest front, Italy is estimated to produce around 47.4 million hl in 2025 (8% more than in 2024) with healthy grapes.

- Grape prices in some regions: in Umbria, Sangiovese ranges from €26-30/quintal, Merlot/Cabernet from €28-30/quintal; for Sagrantino, up to €100-140/quintal.

- Viticultural innovation: smart technology, robotics, and AI applied in the vineyard and cellar are becoming strategic tools for quality and sustainability.

- European wine and spirits M&A activity is slowing sharply, reaching its lowest levels in decades.

M&A Radar

- Deal: Acquisition of Oregon-based Stoller Wine Group by Copper Cane Wines & Provisions – US premium segment. Source: June 15, 2025. (Rumor/Trend) – The number of M&A deals in the wine/spirits sector is sharply declining: 7 wine transactions in H1 2025 vs. higher volumes in previous years.

Prices & Harvest – Mini Box

Harvest 2025

- Estimated production in Italy ~47.4 million hl (8% vs 2024).

- Note: good general conditions, optimal concentration and health of the grapes in many areas.

- In Tuscany: forecast of a voluntary reduction in yields from approximately 2.7 million hl to 2.4 million hl for each quality.

Grape prices

- Umbria: Sangiovese ~€26-30/100 kg; Merlot/Cabernet ~€28-30/100 kg.

- Veneto/Vicenza (DOC): grapes ~€40-60/quintal.

Trend

- Despite a good harvest, grape prices are showing downward pressure in some regions due to potential surpluses and critical foreign markets.

- Technical innovation and quality can be levers for differentiation and improved valorization.