on the main news in the world of wine and wineries, with a strategic eye for those working in the sector.

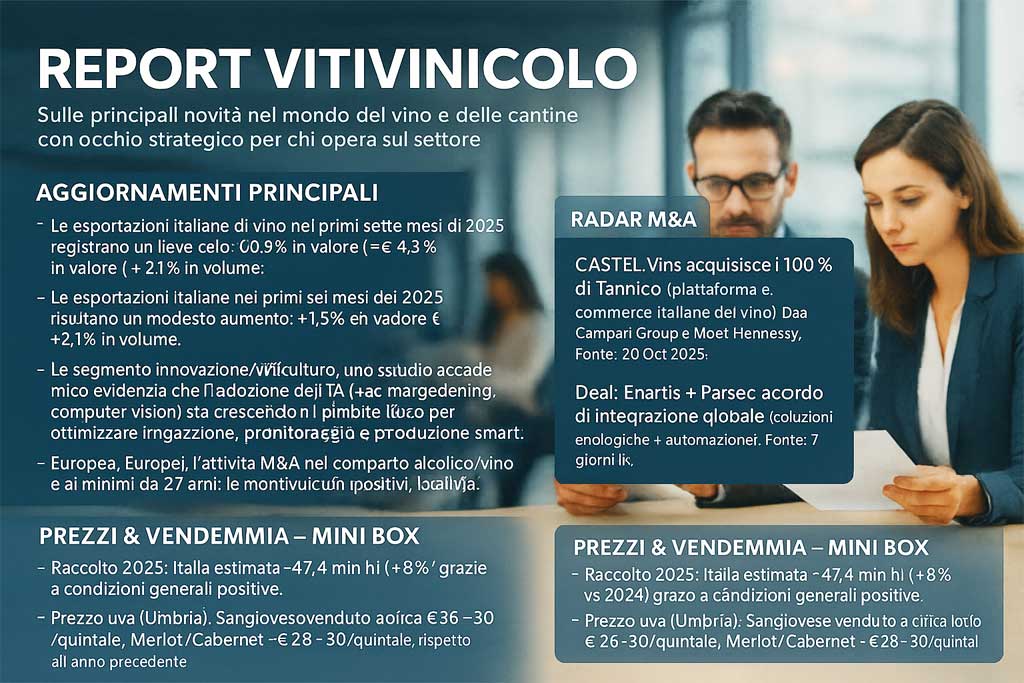

Major updates

- Italian wine exports in the first seven months of 2025 recorded a slight decline: -0.9% in value (≈ €4.63 billion) and -3.4% in volume (~1.23 billion liters). The US market is in negative territory (€135.4 million from €183.8 million a year earlier).

- Italian exports in the first six months of 2025 showed a modest increase: 1.5% in value and 2.1% in volume.

- Italian exports to the United States in the summer months (July-August 2025) show a drastic drop of -28% in value compared to the same period in 2024, despite producers having reduced average prices.

- In the innovation/viticulture segment, an academic study highlights that the adoption of AI (machine learning, computer vision) is growing in the viticulture sector to optimize irrigation, vineyard monitoring, and smart production.

- For the 2025 harvest, Italy is estimated at ~47.4 million hectoliters (8% compared to 2024) with healthy grapes, but in a context of uncertain global demand.

- In the M&A/technology segment, Enartis and Parsec have signed an agreement to create a globally integrated player specializing in winemaking automation solutions.

- At the European level, M&A activity in the spirits/wine sector is at a 27-year low: reasons include low operating liquidity, complex logistics, and a focus on efficiency/distribution.

M&A Radar

- Deal: CASTEL-Vins acquires 100% of Tannico (an Italian wine e-commerce platform) from Campari Group and Moët Hennessy. Source: 20 Oct 2025.

- Deal: Enartis Parsec signs global integration agreement (automation/control winemaking solutions). Source: 7 days ago.

Prices & Harvest – Mini Box

- 2025 harvest: Italy estimated at ~47.4 million hl (8% vs 2024) thanks to positive general conditions.

- Grape prices (Umbria): Sangiovese sold for approximately €26-30/quintal , Merlot/Cabernet ~€28-30/quintal; approximately ‑30% less in value compared to the previous year.

- Bulk wine price: in Italy – for example Toscana rosso ≈ €200/hl, organic Maremma rosso ≈ €155/hl.

- Regional Notes: Although production is increasing, some areas are reporting potential overstocking and slow markets.