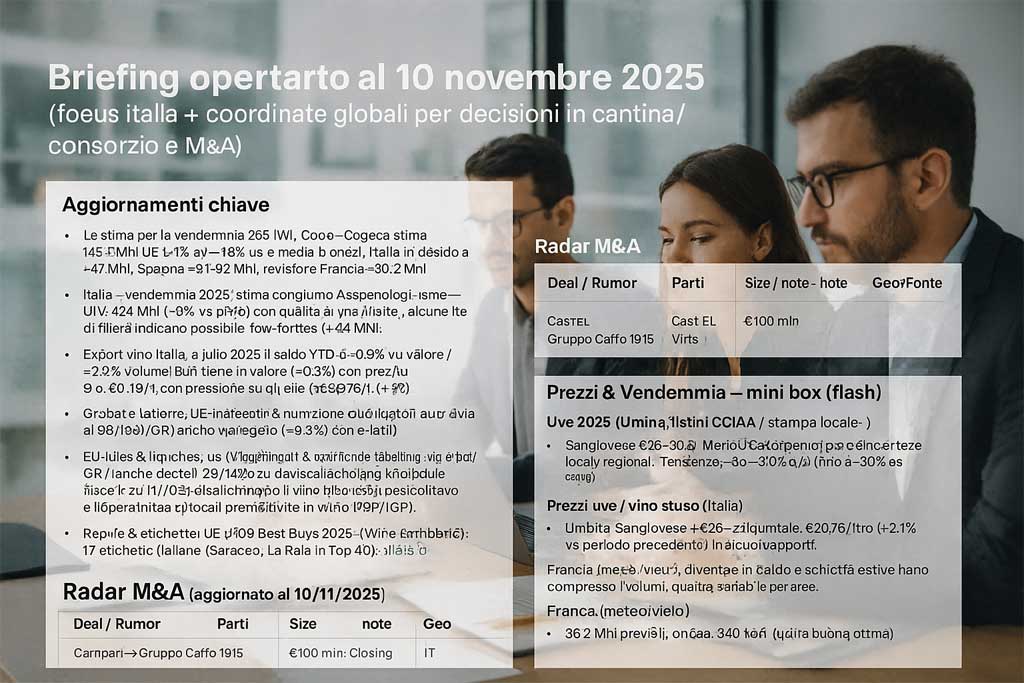

Daily report – November 10, 2025 on the world of wine (Italy & global), designed for those who lead operations in wineries/consortia.

(Focus on Italy, global coordination for winery/consortium decisions and M&A)

- 2025 harvest (EU/Italy/France): Copa-Cogeca estimates 145.5 Mhl EU (1% y/y; −7.5% vs. 5-year average). Italy leads with ~47 Mhl , Spain ~31–32 Mhl; France revised to ~36.2 Mhl due to heat and drought.

- Italy – 2025 harvest: joint Assoenologi–Ismea–UIV estimate: 47.4 Mhl (8% vs 2024) with good/excellent quality; some supply chain readings indicate a possible “low-forties” (~44 Mhl) .

- Italian wine exports: in July 2025 the YTD balance is −0.9% value / −3.4% volume ; USA in negative territory and affected by 15% tariffs (since August): −28% in value in the two-month period July-August .

- Italian stocks: as of 09/30/2025 in the cellar ~36 Mhl (-9.6% vs July; 1.3% y/y) → pressure on bulk price lists.

- Global market H1-2025: world trade −2.3% value / −3.7% volume ; bulk holds steady in value (−0.3%) with average price ~€0.78/L ( 2.1%) .

- Rules & Labels: EU: Ingredients & Nutrition Facts mandatory from December 8, 2023 (also via e-label/QR ). OIV updates the 2025 standards (Codex/Practices/Labeling). In Italy, decrees of December 20, 2024, and May 14, 2025, regulate (partially) dealcoholized wine and its use in mixed-use premises; restrictions on PDO/PGI remain in place according to the current texts/amendments.

- Awards/Rankings: “ Top 100 Best Buys 2025 ” (Wine Enthusiast): 17 Italian labels (Saracco, La Raia in the Top 10).

M&A Radar (updated 10/11/2025)

| Deal / Rumor | Parts | Size / note | Geo | Source |

|---|---|---|---|---|

| Transfer of the Cinzano & Frattina brands | Campari → Caffo Group 1915 | €100 million ; closing expected by the end of 2025 | IT | |

| Tannic (closing 06/10/25) | CASTEL-Vins ↔︎ Tannic | nd | IT/FR | |

| Talloria Valley (former Giordano complex, IWB) – binding offer | Caffo Group 1915 ↔︎ Italian Wine Brands | nd; “new Cinzano House”; move expected by the end of 2025 | IT (Piedmont) |

Prices & Harvest — mini box (flash)

Grapes 2025 (Umbria, Chamber of Commerce price lists / local press – October):

- Sangiovese €26–30/q; Merlot/Cabernet €28–30/q; Sagrantino DOCG €100–140/q. Trends: −~30% y/y (up to −50% vs 2023); the only exception is Trebbiano Spoletino, which is rising sharply due to scarcity.

Bulk wine (global):

- H1-2025 average bulk price ~€0.78/L (2.1%), weak trade; in Italy demand is cautious with high inventories .

Stocks & Returns (Italy):

- Stocks ~36 Mhl as of September 30; harvest ~47.4 Mhl (good/excellent quality) with possible reductions in some areas.

France (weather/yield):

- 36.2 Mhl expected; heat waves and summer droughts have compressed volumes, quality varies by area.