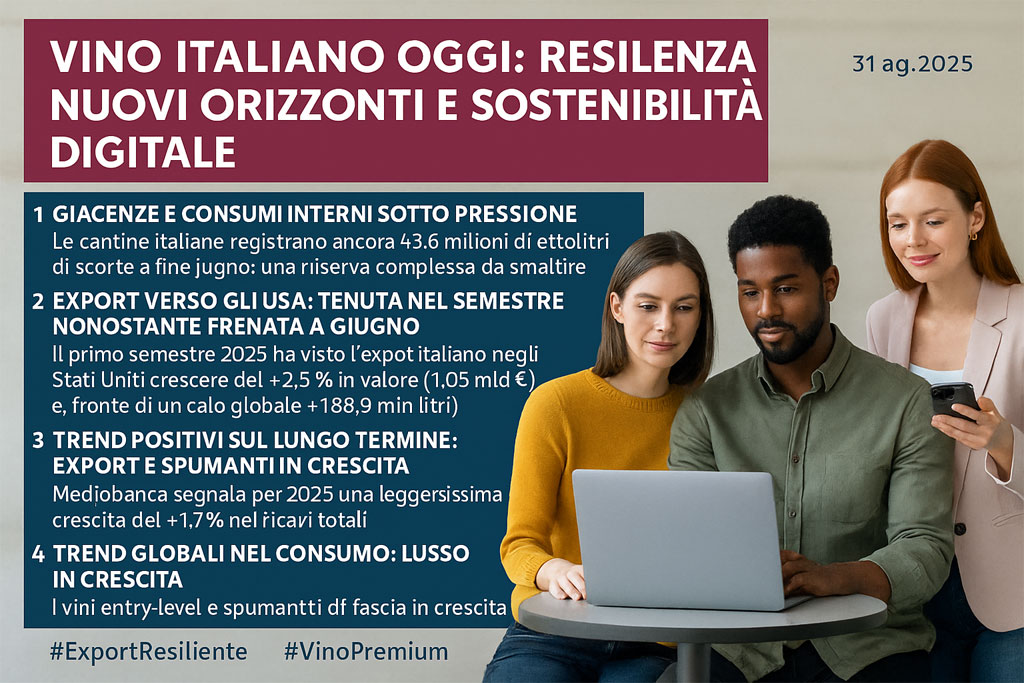

“Italian Wine Today: Resilience, New Horizons, and Digital Sustainability”.

- Inventories and domestic consumption under pressure. Italian wineries still held 43.6 million hectoliters of stocks at the end of June: a complex reserve to clear. Domestic consumption continues to slow, primarily due to health concerns and stricter regulations.

- Exports to the USA: held up in the first half of the year despite a slowdown in June. The first half of 2025 saw Italian exports to the United States grow by 2.5% in value (€1.05 billion) and 7.5% in volume (188.9 million litres), although a slight decline was recorded in June.

- Positive long-term trends: exports and sparkling wines on the rise. Mediobanca reports a very slight growth of 1.7% in total revenues and 2% in exports for 2025; sparkling wines lead the sector with 4.4% of revenues and 6.1% of exports .

- Global consumption trends: luxury on the rise Entry-level wines and low-end sparkling wines show a –6% in sales, while wines over $40 show a remarkable 47%.

- Wine tourism and digital advancement: the future is experiential and smart. Italian wine tourism is booming with programs like “Cantine Aperte in Vendemmia” (Open Cellars for Harvest)—tours, tastings, workshops, and activities for families and young people. Furthermore, digital sustainability applied to viticulture, production, and tourism (chatbots, virtual tastings, smart irrigation) is rapidly expanding.

- #ResilientExport

- #PremiumWine

- #DigitalWineTourism

Strategic conclusion

Italian wine is navigating a challenging period: high inventories and declining domestic consumption require rapid strategic responses. However, exports remain resilient, especially to the US, while the premium segment offers room for growth. The recovery depends on leveraging niche markets, wine tourism experiences, and the intelligent adoption of technology. As a trusted partner , your strength lies in transforming these challenges into high-value, highly effective operations.