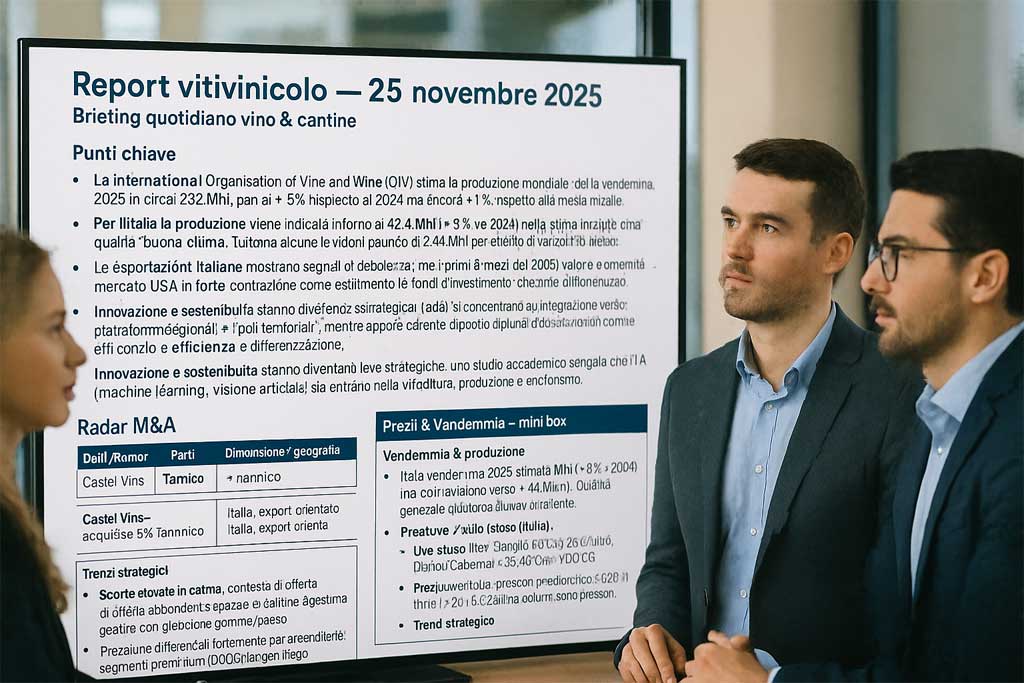

Daily wine & cellar briefing.

Key points

- The International Organisation of Vine and Wine (OIV) estimates world production for the 2025 harvest at around 232 Mhl , equal to 3% compared to 2024 but still ≈‑7% compared to the five-year average .

- For Italy, production is initially estimated at around 47.4 Mhl (8% vs. 2024), with “good-excellent” quality. However, some revisions suggest a figure of ≈ 44 Mhl due to weather variability.

- Italian exports are showing signs of weakness: in the first 8 months of 2025, the value is -1.9% compared to 2024 (≈ €5 billion in August) and the US market is in sharp contraction: -30% in August alone.

- The global bulk wine market recorded decreasing volumes (≈‑2.3% H1 2025 vs H1 2024), but substantially stable values thanks to the increase in the average price per litre (≈ €0.78/L, 2.1%).

- The M&A landscape in Italy remains fragmented: deals are focused on vertical integration, regional platforms, and “territorial hubs,” while the contribution of investment funds appears lacking.

- Innovation and sustainability are becoming strategic levers: an academic study reports that AI (machine learning, computer vision) is entering viticulture, production, and wine tourism as a tool for efficiency and differentiation.

- The regulatory and labeling landscape is evolving: environmental, informational, and digital (QR, traceability) requirements are growing, which for wineries are becoming not only compliance but also a potential positioning lever. (Source: industry analysis)

M&A Radar

| Deal/Rumor | Parts | Size / Geography | Notes |

|---|---|---|---|

| Castel Vins acquires 100% of Tannico (Italian digital wine platform) | Castel Vins → Tannic | Italy, export oriented | Digitalization signal & logistics platform in wine. |

Prices & Harvest – mini box

Harvest & Production

- Italy 2025 harvest estimated at ≈ 47.4 Mhl (8% vs 2024) but with revisions towards ≈ 44 Mhl. Overall quality judged good-excellent.

- Weather notes: Harvest early in many areas, fair health conditions, volumes below expectations in some regions.

Grape / bulk wine prices (Italy)

- Umbrian Grapes: Sangiovese ~26-30 €/q, Merlot/Cabernet ~28-30 €/q; Sagrantino DOCG ~100-140 €/q.

- Bulk wine in Italy: average price around €0.78/litre (2.1% vs. previous period) but volumes under pressure.

Strategic trends

- High stocks in the cellar: a context of abundant supply pushes wineries to carefully manage range/price.

- Grape prices vary significantly by area/grape: premium segments (DOCG) are holding up better.

- The need to transform “quantity into value”: positioning, foreign markets, and innovation become key levers.